Nigeria’s agricultural sector roared into the global spotlight last Sunday, February 23rd, 2025, during a virtual Town Hall that convened influential voices from both the Federal Government and the diaspora. Organized by the Nigerian & Canadian Business Network (N&CBN) in collaboration with Kampe Health Plans, the event showcased a keynote by the Minister of Agriculture and Food Security, Senator Abubakar Kyari, alongside insights from Hon. Abike Dabiri-Erewa, Ambassador Bolaji, and Acting High Commissioner A.K. Zanna. Also giving insight is Dil Vashi, vice president of Cstainable. Their message was clear: Nigeria’s agriculture is ready for major growth, and diaspora Nigerians, especially those in Canada, are in a prime position to invest and help strengthen the nation’s food security and economy.

Investment Opportunities in Nigeria’s Agriculture

The Minister’s presentation lays out a holistic roadmap for transforming Nigeria’s agriculture sector across three key segments: upstream, midstream, and downstream. Each stage is packed with opportunities for investors and business owners looking to be part of the country’s emerging agricultural renaissance:

- Upstream Opportunities

- Seed Technology & Mechanization: With only 10% of Nigerian farmers using improved seeds and a tractor density of 0.27 horsepower per hectare (far below the FAO-recommended 1.5 hp/ha), investments in seed research, manufacturing, and equipment leasing can significantly boost yields. The government’s plan to register genuine farmers through the National Identity Management Commission (NIMC) ensures that interventions like seed subsidies and mechanization reach the right people.

- Fertilizer Production & Distribution: Fertilizer consumption in Nigeria has grown at a compound annual rate of 10%, yet usage (18 kg/ha) still lags far behind the global average (134 kg/ha). Local fertilizer plants, blending facilities, and mobile testing labs are crucial to increasing productivity and meeting the government’s food security goals .

- Midstream Opportunities

- Storage & Post-Harvest Handling: Nigeria loses an estimated USD 2.4 billion to post-harvest losses annually, particularly in grains, fruits, and vegetables. Constructing modern silos, cold chain systems, and other storage facilities represents a vital investment avenue. Such infrastructure can also help bridge the country’s grain deficit and stabilize food prices.

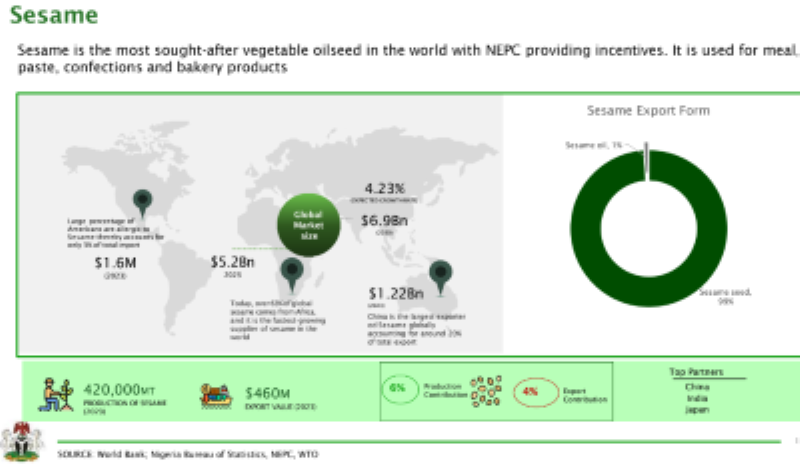

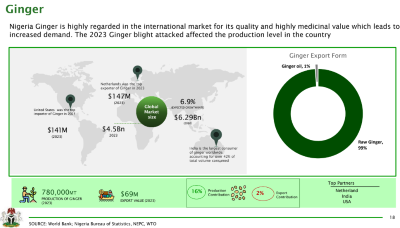

- Processing & Value Addition: Converting raw materials—like tomatoes, sugarcane, and dairy—into finished goods can multiply income for both smallholder farmers and large-scale operators. Moving beyond raw exports in key commodities (e.g., sesame, ginger, cocoa) to high-value products like oils, extracts, and packaged foods positions Nigeria to compete in premium global markets, increasing export revenue.

- Downstream Opportunities

- Distribution & Market Access: Upgraded transport, reliable power supply, and digital platforms can connect producers to urban centers and international buyers. With a growing population at home and strong demand abroad, improved logistics will facilitate efficient trade while reducing post-harvest losses even further.

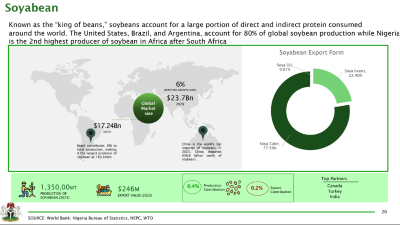

- Export Expansion: Crops such as cocoa, sesame, ginger, hibiscus, soybean, and cashew already feature strongly in Nigeria’s export mix. However, most are currently shipped in raw form. Exporters can break into higher-value segments of the global supply chain by focusing on quality control, certification, and branding.

In addition to these sector-specific opportunities, the minister underlined Nigeria’s strategic advantages, such as a large consumer market, expansive arable land, and supportive government policies. Ongoing plans to supply farmers with 4,000 tractors and 16,000 implements, coupled with a newly approved N1.5 trillion credit facility at the Bank of Agriculture, highlight the government’s resolve to create an environment where agri-businesses can thrive.

Altogether, the minister’s presentation underscores Nigeria’s readiness for significant agricultural expansion. By investing in upstream inputs, fortifying midstream processes, and capitalizing on downstream market prospects, both domestic and diaspora investors stand to benefit from a sector poised for robust growth.

From Sesame to Ginger, Cocoa, and Beyond

A New Ministry and a Renewed Vision

One of the most striking developments is the renaming of the Ministry from “Agriculture and Natural Resources” to “Agriculture and Food Security.” As Minister Kyari emphasized, this is not mere rebranding, it is a statement of intent. Nigeria’s population of over 220 million is on track to hit 400 million by 2050, a staggering figure that underscores the urgent need for robust, scalable food systems. “Ensuring food security for our ever-growing population is a must,” the minister declared. Under President Bola Ahmed Tinubu’s Renewed Hope Agenda, food security is one of eight cardinal points, paired with a reported 40% decrease in food prices just in the last month. These indicators aim to reassure potential investors that the country is moving in a direction that supports viable returns.

The Diaspora’s Role in Bridging Gaps

Traditionally, the diaspora’s relationship with Nigeria has often revolved around remittances and philanthropic endeavors. However, the virtual Town Hall sought to change that narrative. According to Minister Kyari, Nigeria’s agricultural workforce makes up around 35% of the nation’s labor force, but that workforce alone cannot meet the demands of rapid population growth. During his presentation, Kyari outlined a series of strategic interventions:

• Partnering with the National Identity Management Commission (NIMC) to properly register and identify genuine farmers, so that government interventions reach the right hands.

• Acquiring 4,000 tractors and 16,000 farming implements to mechanize agriculture and boost productivity.

• Facilitating an N1.5 trillion credit facility, housed at the Bank of Agriculture, to provide easier access to funding for agribusiness ventures.

These interventions reflect points highlighted in the Ministry’s “Investment Opportunities in the Agriculture Industry” presentation, which lays out the case for investing in fertilizer production, seed and mechanization technology, and post-harvest infrastructure such as cold storage and processing plants .

Why Now Is the Time

For African diaspora members who have hesitated to invest, concerns often revolve around security, policy continuity, and infrastructural bottlenecks. Addressing these directly, the minister noted that the 2025 budget earmarks a record N6 trillion for security and defense—underscoring President Tinubu’s commitment to stabilizing regions historically plagued by instability. This assurance, combined with the proposed credit facilities and wide-ranging government incentives—including full capital allowance for agro-allied companies and exemptions from certain taxes—signals a shift in how Nigeria is courting diaspora investment .

Beyond Raw Produce: Value-Added Exports

A powerful takeaway from the minister’s presentation was the emphasis on moving beyond raw crop production into value-added exports. Cocoa, sesame, ginger, cashew, and soybean are among Nigeria’s top export crops, yet much of their global trade is in unprocessed form. By investing in processing plants—such as refining sesame seeds into sesame oil or turning ginger into essential oils—entrepreneurs can tap into premium markets that multiply profit margins many times over .

Seizing the Momentum—A Call to the Diaspora

Sunday’s event was more than just speeches, it served as a blueprint for action. Attendees heard from NIDCOM Chair Hon. Abike Dabiri-Erewa and diaspora investors like Toyin Ajayi, a Nigerian farmer based in British Columbia, Canada, who underscored the feasibility of bridging two worlds to create transformative agribusiness models. “Whether you’re a seasoned investor, business professional, or simply passionate about agriculture, this is your chance to contribute to national development and secure lucrative returns,” organizers proclaimed.

For many in the diaspora, who maintain emotional and financial ties to Nigeria, this clarion call resonates more than ever. Rising global food prices, ongoing supply chain disruptions, and a swelling youth population all converge to make Nigeria’s agriculture sector ripe for innovation and growth. If the government delivers on security measures and continuous infrastructural investment, diaspora stakeholders could find themselves on the ground floor of a sector poised for explosive expansion.

Toward a Monthly Affair

The Town Hall concluded with Chairman of the Nigerian Canadian Business Network, King Wale Adesanya, expressing hope that such engagements will become a monthly affair. The next speaker, potentially the Minister of Health, will likely continue the dialogue about fostering synergy between public policy and private investment.

From a purely commercial standpoint, Nigeria’s agriculture sector offers both scale and diversity, a sure draw for investors. Yet this is not solely about profit. For African diaspora communities, it is also about leveraging transnational identities for meaningful, sustainable development back home. Bridging cultures, competencies, and capital might just be the ticket to transforming Nigeria’s agriculture from an underperforming sector into a global powerhouse.

If the buzz surrounding Sunday’s event is any indication, this is a conversation that’s only just beginning—and one that promises to spark both enthusiasm and debate among Nigerians worldwide.

This can be a good way to diversify the economy in the real sense of diversification