Education is often seen as the pathway to a better future, but a recent TD Bank survey reveals a stark reality for many Canadian students: nearly half are struggling to meet their basic needs. With tuition fees, rent, and grocery prices soaring, the dream of a better future is overshadowed by financial stress. What’s behind this crisis, and what can be done to help?

Financial Instability: A Growing Crisis for Students

The 2024 TD Bank survey highlights a worrying trend: 65% of Canadian students feel financially unstable. Even more alarming is that 45% of students report being unable to afford essentials like food and housing. These statistics tell a grim story, but behind each number is a real person facing real challenges.

Take Sarah, a third-year international student from Nigeria studying in Toronto. Despite working two part-time jobs, she often finds herself choosing between paying rent and buying groceries. “I came to Canada to build a better life, but sometimes it feels like I’m just surviving,” she says. Sarah’s story is not unique; it mirrors the struggles of many students trying to navigate the high costs of living in Canada.

The Impact of Inflation and Economic Policies

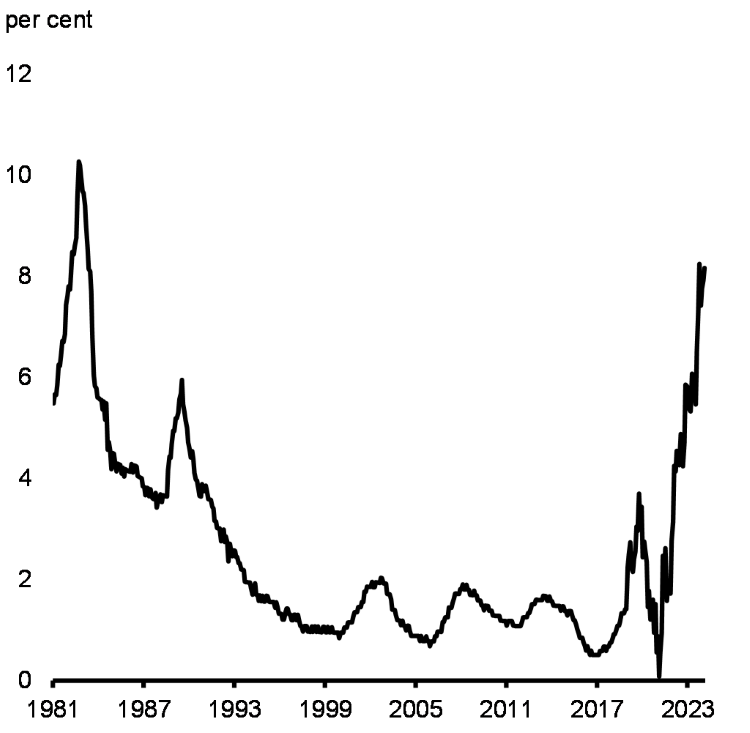

Source: Statistics Canada

The rising cost of living in Canada is a significant factor in students’ financial struggles. According to the TD Bank survey, inflation has driven up the cost of essential items like rent and groceries. This inflation is hitting students hard, particularly those in cities like Vancouver and Toronto, where housing costs are among the highest in the country.

As reported by Zumper, which analyzes rental data from hundreds of thousands of active listings nationwide, the average cost of renting a one-bedroom apartment in Toronto has now reached $2,300 per month. This steep price likely explains why many residents are finding creative living arrangements. As of August 2024, the median rent for a one-bedroom apartment in Toronto, ON stands at $2,346, which is 42% above the national average. For students like Sarah, who rely on part-time work and limited financial aid, such costs are simply unaffordable.

Moreover, economic policies have not kept pace with these rising costs. Tuition fees have increased by an average of 3% annually over the past decade, while financial aid and scholarships have not seen comparable growth. Minimum wage jobs, which many students rely on, offer wages that have not kept up with inflation, leaving students to bridge the gap with loans and credit cards.

Financial Literacy: A Critical Gap

Another significant finding from the TD Bank survey is the lack of financial literacy among students. Although 64% of students have created a budget, only 41% stick to it regularly. Additionally, 61% wish they had more knowledge about budgeting and financial planning. This gap in financial literacy is leading to poor financial decisions, increasing debt, and more significant stress.

Consider Ahmed, a first-year student from Ghana studying engineering in Ottawa. Ahmed admits that he didn’t fully understand the interest rates on his student loans when he took them out. Now, he finds himself overwhelmed by debt and unsure how to manage it. “I wish someone had taught me about money management before I got here,” he says.

Social Media: The New Financial Advisor?

Interestingly, one in five students now turn to social media platforms like TikTok, Instagram, and YouTube for financial advice. While these platforms offer some valuable insights, the quality and accuracy of the information can vary widely. This trend highlights the need for more reliable financial education sources that can provide students with accurate and practical advice.

Solutions: What Can Be Done?

Addressing these financial challenges requires a comprehensive approach that includes:

- Increased Financial Support: Expanding scholarships, grants, and financial aid can help alleviate the financial burden on students. For example, more targeted grants for international students could make a significant difference in their ability to afford basic needs.

- Financial Literacy Education: Schools and universities should provide robust financial literacy programs to equip students with the skills to manage their finances effectively. This education could be integrated into orientation programs for international students or offered as workshops throughout the academic year.

- Policy Reforms: Policymakers need to address the rising cost of living and ensure that minimum wages and financial aid keep pace with inflation. Proposals such as capping tuition fees or offering rent subsidies for students in high-cost cities could also be considered.

- Parental Resources: Offering resources and support for parents can help them manage the financial strain of supporting their children through college. This support could include financial planning tools or workshops focused on budgeting for post-secondary education.

- Community Support: Communities, including the African diaspora, can play a role by offering mentorship programs, networking opportunities, and sharing resources to help students navigate financial challenges. Many of these communities have been doing a lot in this area.

The Bottom Line

The findings from the TD Bank survey reveal a significant financial struggle among Canadian students, with nearly half unable to cover basic needs. This challenge also extends to their families. Addressing these issues requires a joint effort from educational institutions, policymakers, and the students themselves. By enhancing financial support, improving financial literacy, and reforming economic policies, we can help students achieve the financial stability they need to succeed.

Sarah, Ahmed, and countless others like them deserve a chance to focus on their studies without the constant worry of making ends meet. Share your thoughts or experiences on this issue in the comments below. Let’s work together to find solutions.